Changing the tax rate of an item

Authorized users can change the tax rate of an item in a transaction.

Configurable features

The POS can be configured to enable the Tax Override button on the item-related options and on the Sale Main Menu screen. Refer to the following option:

- Tax Override Setup > Manual Tax Override

Follow these steps:

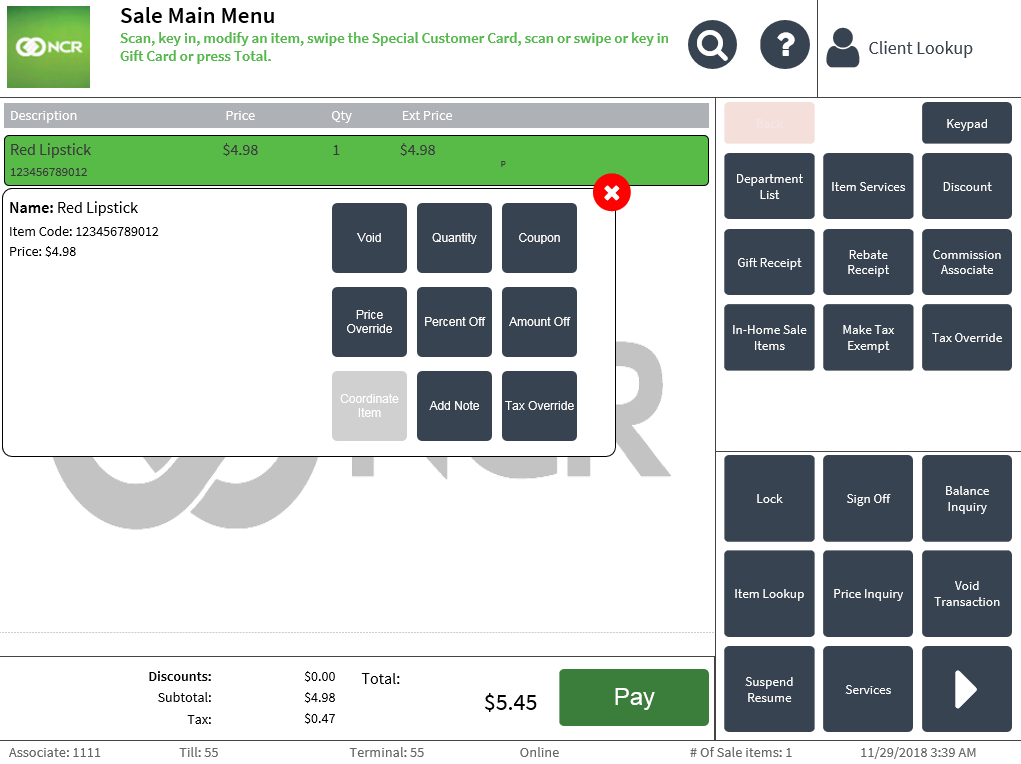

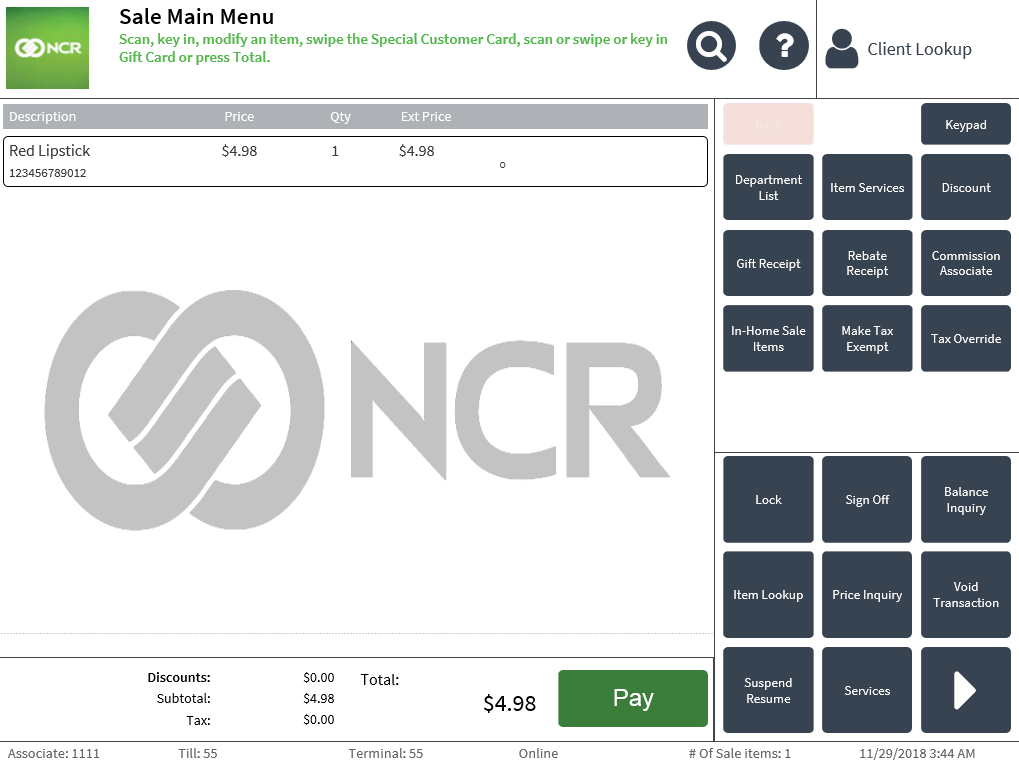

- On the Sale Main Menu screen, select the item with the tax rate to be changed. The application displays the item-related options. Note

If the item is not eligible for tax override, the Tax Override button is not enabled.

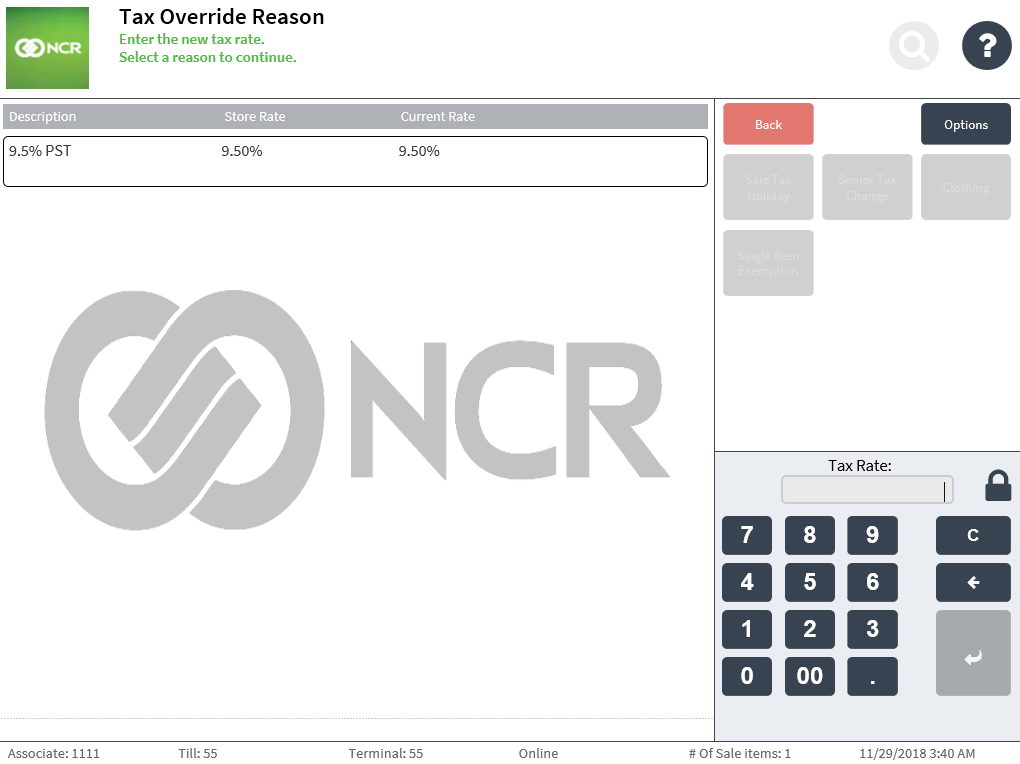

- Select Tax Override. The application displays the Tax Override Reason screen.Note

If the selected item has compounded tax rates, the associate selects which tax rate to change on the Item Tax List screen before proceeding to the Tax Override Reason screen.

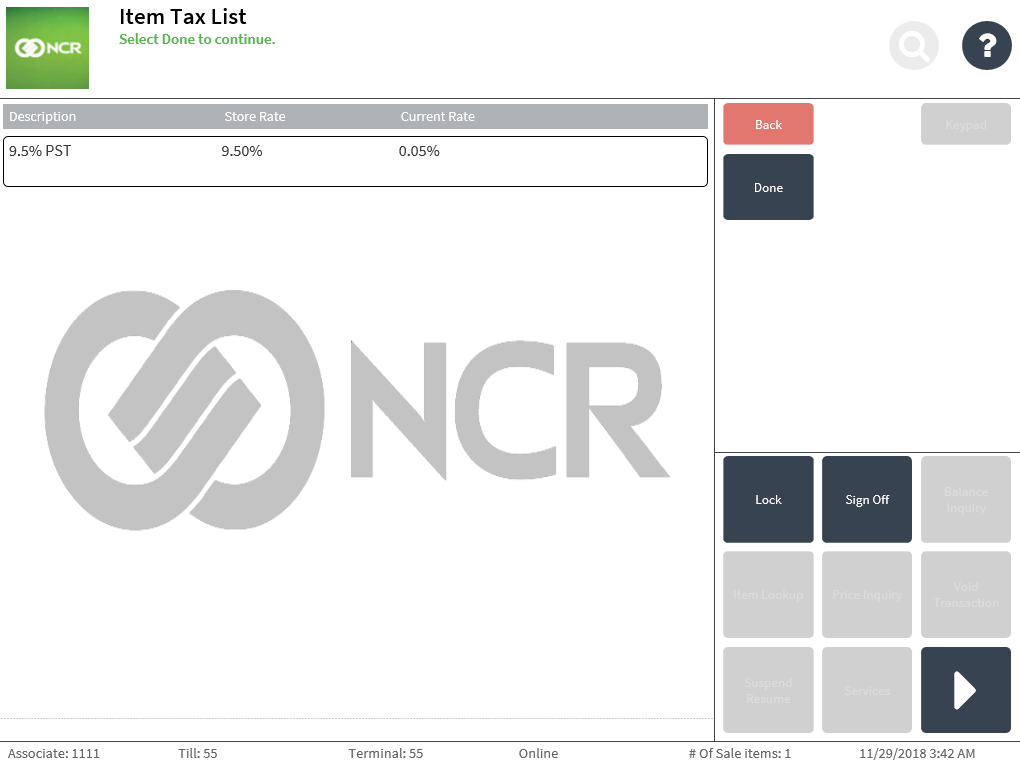

- Enter the new tax rate, and then select a reason for the tax rate change. The application displays the Item Tax List screen with the original store tax rate and the current tax rate.Note

The tax override reasons are enabled only after entering the new tax rate.

- Select Done. The application displays the Sale Main Menu screen.

Note

NoteFor items with modified tax rates, the POS replaces the original tax character with a tax character of O. For more information on tax characters, refer to Understanding tax types.

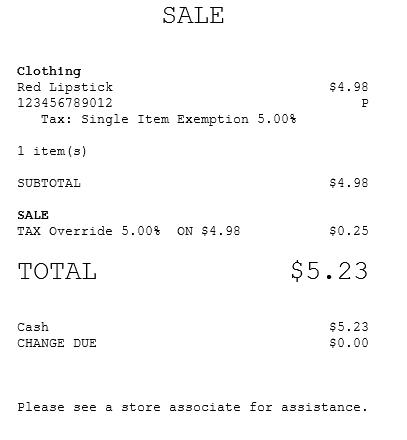

- Complete the transaction. The tax rate change is reflected on the receipt.

Receipt with item-level tax override